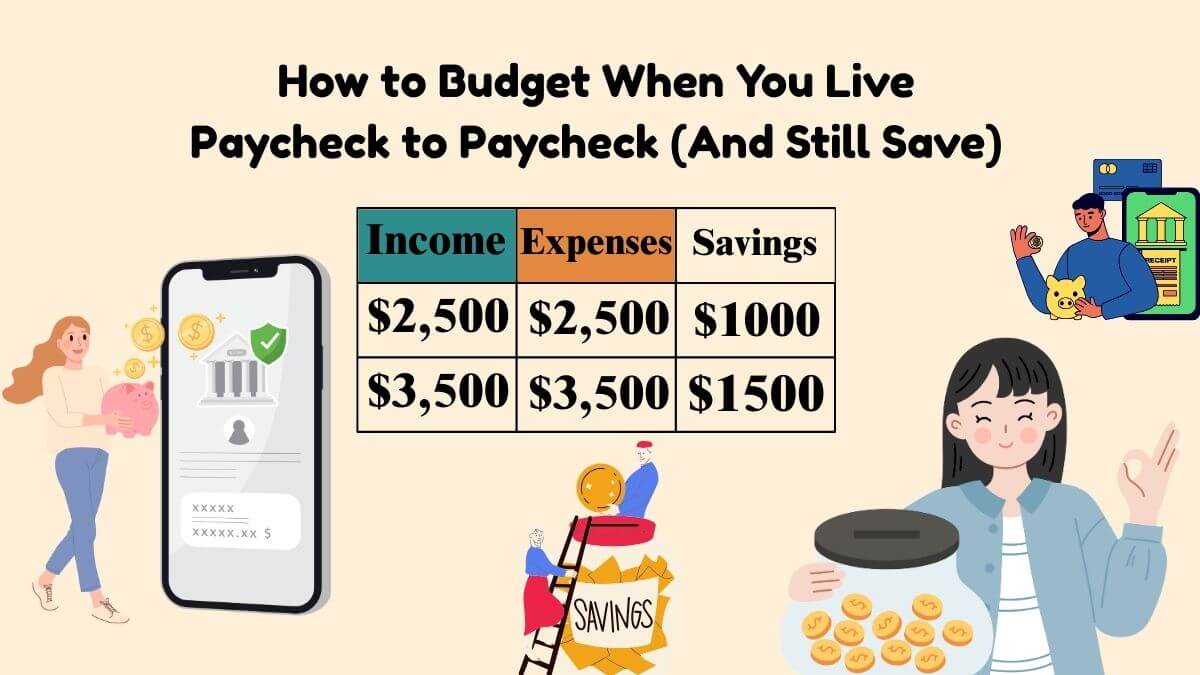

Living paycheck to paycheck is a reality for many people in the U.S. Whether you’re just getting started on your financial journey or have been struggling for some time, it can feel like an uphill battle. But the truth is, budgeting when you live paycheck to paycheck is not only possible, it’s essential for building financial stability.

In this guide, we’ll cover step-by-step methods on how to budget when you live paycheck to paycheck, how to save while living paycheck to paycheck, and realistic budget tips that will help you achieve your financial goals.

By the end of this post, you’ll have the tools and knowledge to turn things around with a paycheck budget plan, and finally stop the cycle of living paycheck to paycheck. Plus, we’re sharing a customizable budget template to help you get started!

Table of Contents

How to Budget When You Live Paycheck to Paycheck

Creating a budget when you live paycheck to paycheck is the first step in gaining control of your finances. The goal is to prioritize essential expenses, reduce unnecessary spending, and allocate what you can to savings. It might feel overwhelming, but it’s completely manageable with the right approach.

How to Start a Budget Paycheck to Paycheck

- 1. Track Your Income and Expenses:

Begin by understanding your total income and monthly expenses. This includes rent, utilities, groceries, transportation, and any debt payments. You should also track irregular expenses such as annual insurance payments or subscription renewals.

Use an app or a simple spreadsheet to monitor where your money goes. Knowing exactly where you spend helps you see unnecessary expenses.

- 2. Budget by Paycheck Workbook:

If you’re just getting started, a budget by paycheck workbook is a great way to organize your finances. You can track every paycheck, know exactly where each dollar is going, and adjust accordingly.

- 3. Create a Simple Budget:

After listing your expenses, allocate money to each category. Make sure you cover your essentials first, such as housing and food. Anything left over should be used to pay off debt or added to savings.

👉 If you want to know: Sample Budget for $2500 a Month: A Realistic Guide for Young Adults

👉 If you want to know: Free Downloadable 2025 Budget Template Google Sheet

💡 Pro Tip:

A budget paycheck to paycheck system works best when you regularly update it. It may feel like extra work, but updating your budget with each paycheck will keep you on track and motivated!

Paycheck Budget Plan

A paycheck budget plan is a detailed outline of your income and expenses for each paycheck. It’s an essential tool for managing finances on a limited income. Here’s how to create a solid paycheck budget plan:

- 1. Identify Fixed Expenses

These are regular bills that are the same each month, such as rent, utilities, or car payments. Make sure you account for them first.

- 2. Allocate for Variable Expenses

These expenses can fluctuate, such as groceries, gas, and entertainment. Estimate the average amount spent each month and adjust accordingly.

- 3. Include Savings and Debt Repayment

Even when living paycheck to paycheck, it’s important to put a little aside for savings or debt repayment. Start small, but make sure you’re consistently saving or paying down debt.

💡 Pro Tip:

If your income varies, create two paycheck budget plans — one for a high-income month and one for a low-income month. This will give you flexibility while sticking to your budget.

🔗 Related:

- 👉 How to Budget When You Live Paycheck to Paycheck (And Still Save)

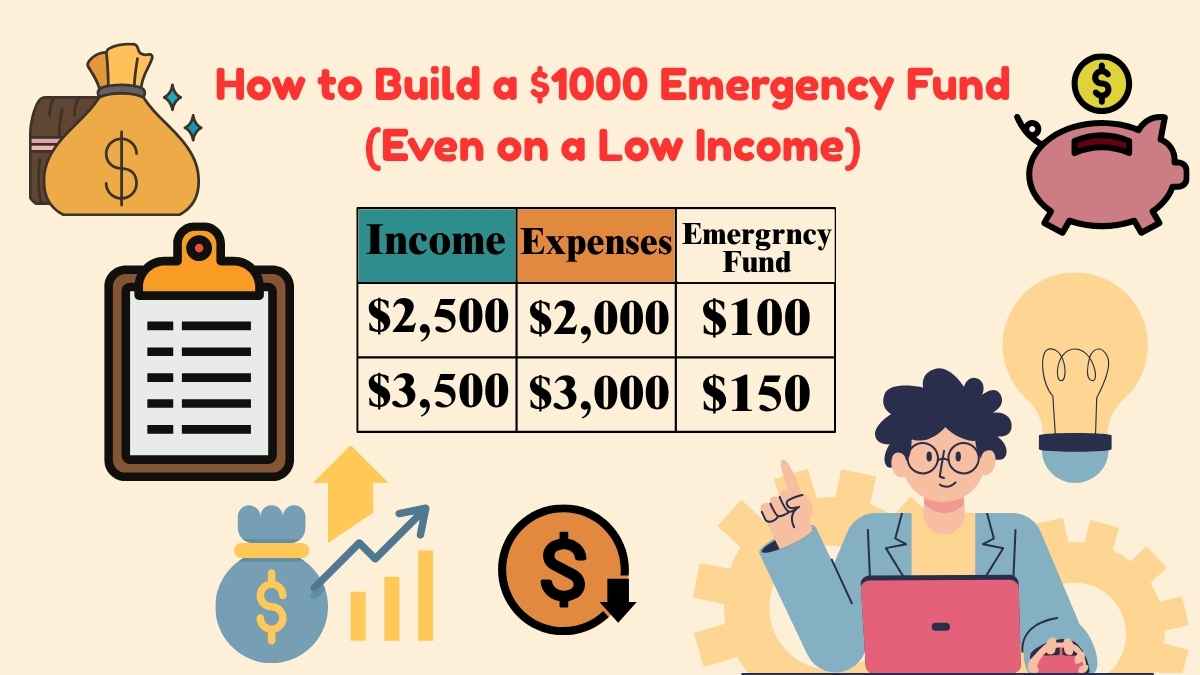

- 👉 How to Build a $1000 Emergency Fund (Even on a Low Income)

- 👉 How to Pay Off Debt Fast with Low Income

- 👉 Sample Budget for $2500 a Month: A Realistic Guide for Young Adults

How to Save While Living Paycheck to Paycheck

Many people wonder, “How can I save money living paycheck to paycheck?” It’s possible, even on a tight budget, if you’re strategic. Here’s how to make saving a priority:

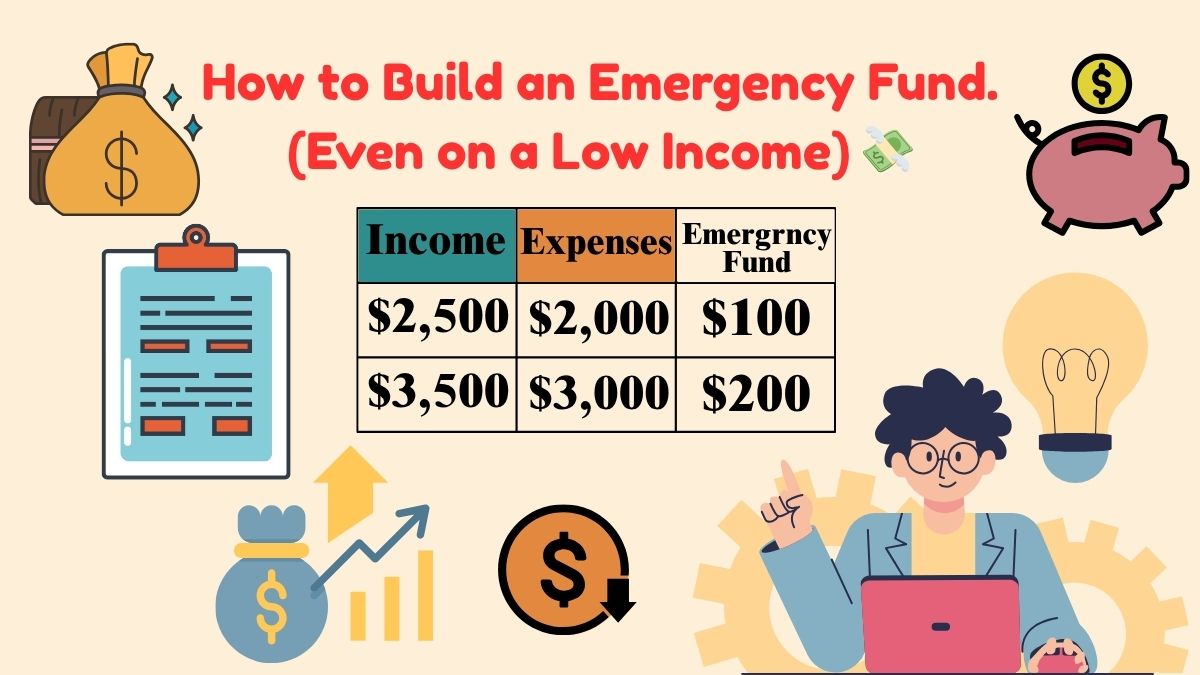

- 1. Set Realistic Savings Goals

Even if it’s just $25 per paycheck, saving something is better than nothing. Start small and gradually increase the amount as you reduce your expenses.

- 2. Automate Your Savings

Set up an automatic transfer to a savings account every time you receive your paycheck. This makes saving a habit and ensures you don’t forget.

- 3. Cut Back on Non-Essential Spending

Evaluate your discretionary spending (e.g., dining out, subscriptions, and shopping). Cutting back here can free up money to put toward savings.

💡 Pro Tip:

Use a weekly paycheck budget planner to track your spending weekly, so you can adjust as necessary and prevent overspending.

Realistic Budget Tips

Creating a realistic budget tips is about finding balance. It’s not just about cutting out all luxuries but about managing your priorities effectively. Here are some tips:

- 1. Prioritize Needs Over Wants:

Make sure your essential needs, such as housing, transportation, and food, come first. After that, allocate money for non-essentials and savings.

- 2. Reevaluate Regularly:

Review your budget at least once a month to ensure it reflects your current income and lifestyle.

- 3. Track Your Progress:

Keep track of how much you’re saving each paycheck. This will help you stay motivated and adjust when necessary.

- 4. Use Cash for Discretionary Spending:

Consider using cash for entertainment and dining out. This limits how much you can spend and helps you stick to your budget.

💡 Pro Tip:

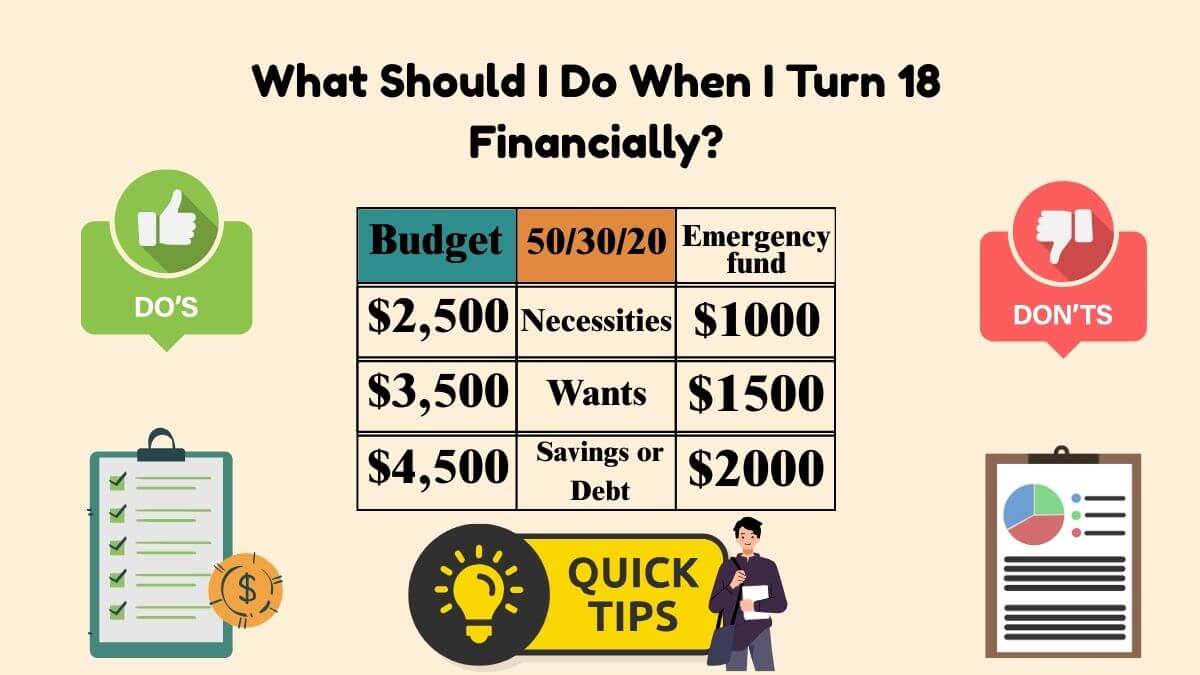

Stick to the 50/30/20 budget rule — allocate 50% for needs, 30% for wants, and 20% for savings and debt repayment. This will keep you on track, even when living paycheck to paycheck.

Weekly Paycheck Budget Planner

A weekly paycheck budget planner can be a game-changer for your finances. It helps you stay organized by breaking down your budget on a weekly basis, rather than monthly. This method works well if your income varies or if you need more frequent check-ins to stay on track.

Here’s how to use it:

- 1. Track Income:

Write down your expected income for the week.

- 2. List Weekly Expenses:

Include weekly costs like groceries, transportation, or utility payments that are due that week.

- 3. Plan for Savings:

Even if it’s a small amount, make sure to allocate part of your income for savings or debt repayment.

- 4. Review and Adjust:

At the end of each week, check how you did. Did you overspend? Were there areas where you could have saved more?

💡 Pro Tip: A

weekly paycheck budget planner works especially well if you get paid weekly or bi-weekly. It gives you a clear picture of where your money is going week by week.

How Many Americans Live Paycheck to Paycheck?

It’s important to understand the reality of living paycheck to paycheck in the U.S. According to a report by The Ascent, about 63% of Americans live paycheck to paycheck. This statistic is a stark reminder that many people are facing financial struggles, but with the right budgeting and savings strategies, you can break free from this cycle.

How to Stop Living Paycheck to Paycheck

The ultimate goal is to stop living paycheck to paycheck. Here are a few steps to help you get there:

- 1. Build an Emergency Fund:

Aim for a small emergency fund of $500 to $1,000 to avoid financial setbacks.

👉 If you want to know: How to Build a $1000 Emergency Fund (Even on a Low Income)

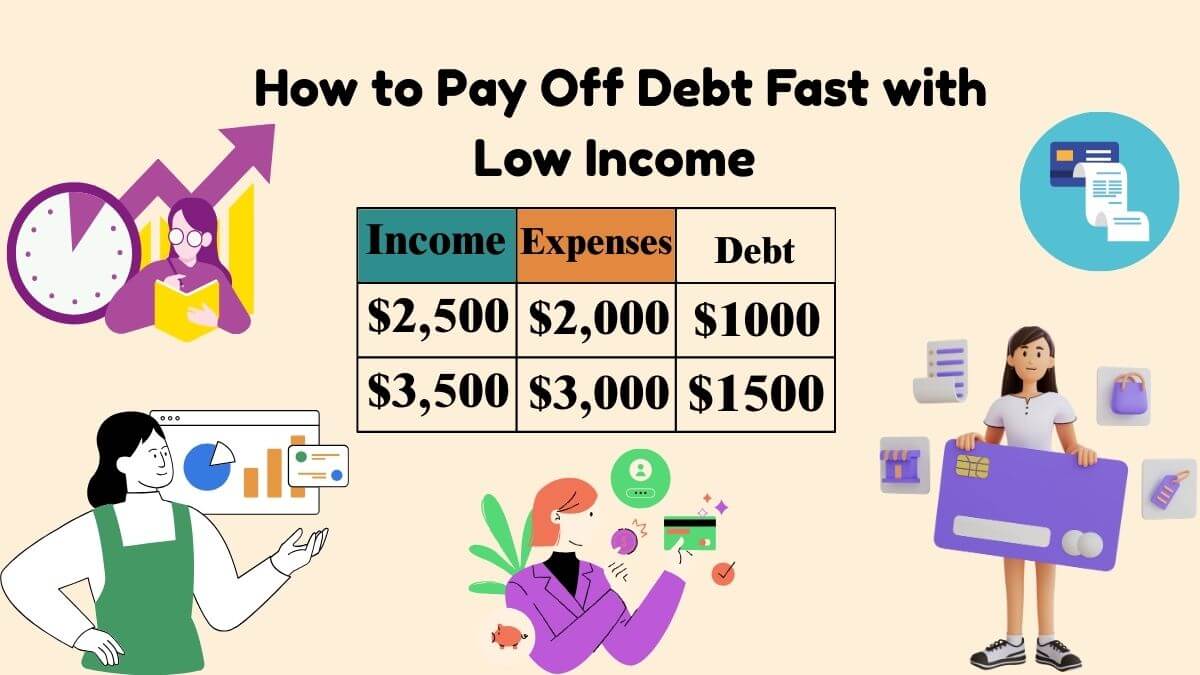

- 2. Pay Down Debt:

Prioritize paying off high-interest debt (like credit cards). The less debt you have, the more money you can allocate to savings.

- 3. Increase Income:

Consider side gigs, freelance work, or asking for a raise to bring in extra money.

💡 Pro Tip:

Breaking the paycheck-to-paycheck cycle takes time. Be patient and persistent, and track your progress as you reduce debt and build savings.

How Much Money Should You Save Each Paycheck?

The general rule of thumb is to save 10% of your income each paycheck. However, depending on your financial goals, you may need to adjust this amount. Start with a small percentage if necessary and increase it as you reduce expenses and debt.

💡 Pro Tip:

Save the first 10% of your paycheck before spending on anything else. By prioritizing savings, you’ll build your emergency fund faster and develop good financial habits.

Want to get started right now? Download our free customizable budget template to create your own paycheck budget plan. It’s simple, effective, and designed to help you save money while managing your expenses!

Progress Dashboard & Downloads (2025 Templates)

2025 Excel & Google Sheets Budget + $1K Tracker

Download now:

Grab your professional budget template with:

- Monthly Budget 2025 sheet (auto totals & net).

- Download the 2025 Emergency Fund & Budget Template

- Emergency Fund Tracker (goal, % to goal, months to goal).

- 1K Challenge (pre‑filled boxes that sum to $1,000).

Final Thoughts

No matter where you’re starting from, budgeting when you live paycheck to paycheck is possible with the right strategies. By following the tips and using the budget paycheck plan outlined here, you can start saving and eventually break free from the cycle of living paycheck to paycheck.

Remember to use tools like a paycheck budget plan, weekly paycheck budget planner, and even a budget by paycheck workbook to keep yourself on track. It takes time, but with consistency, you’ll get closer to achieving your financial goals.

FAQ

Q: How can I stop living paycheck to paycheck?

A: Start by tracking your expenses, paying off debt, and building an emergency fund. Focus on saving a small percentage of each paycheck and cut back on non-essential expenses.

Q: How much should I save from each paycheck?

A: Aim to save at least 10% of your paycheck. Start small if necessary, and increase it as you reduce debt and other expenses.

Q: How do I create a realistic budget?

A: Prioritize essential expenses, be flexible with your budget, and track your progress regularly. Use tools like a paycheck budget plan and a weekly paycheck budget planner to stay on track.