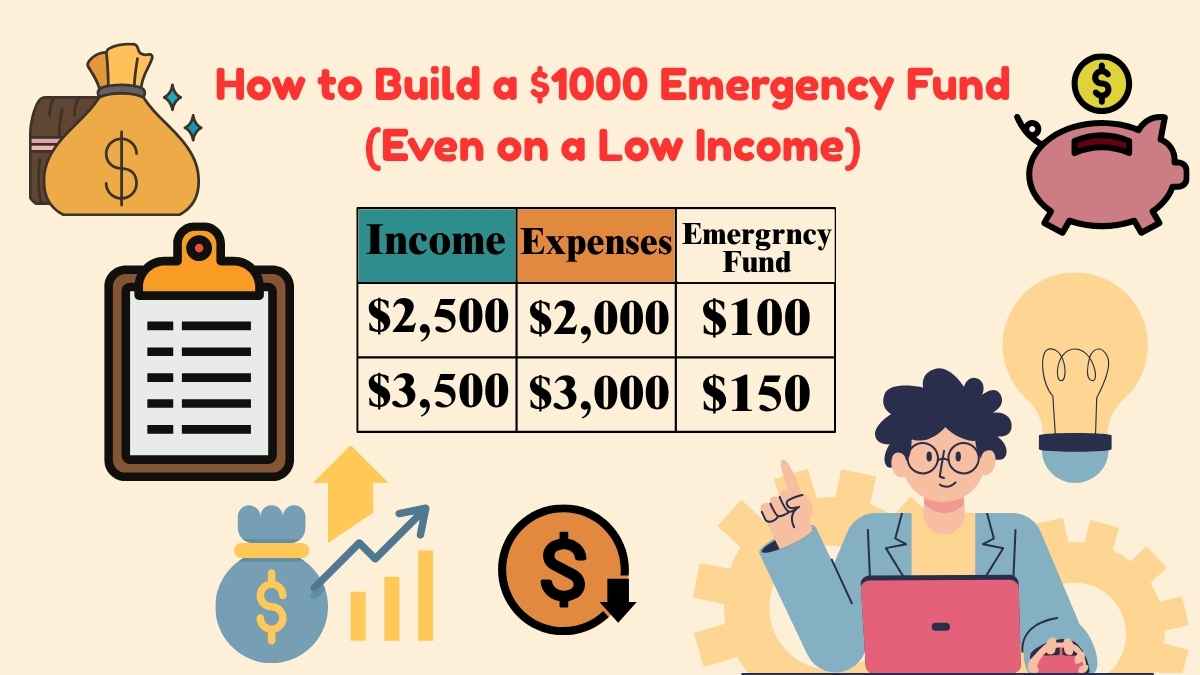

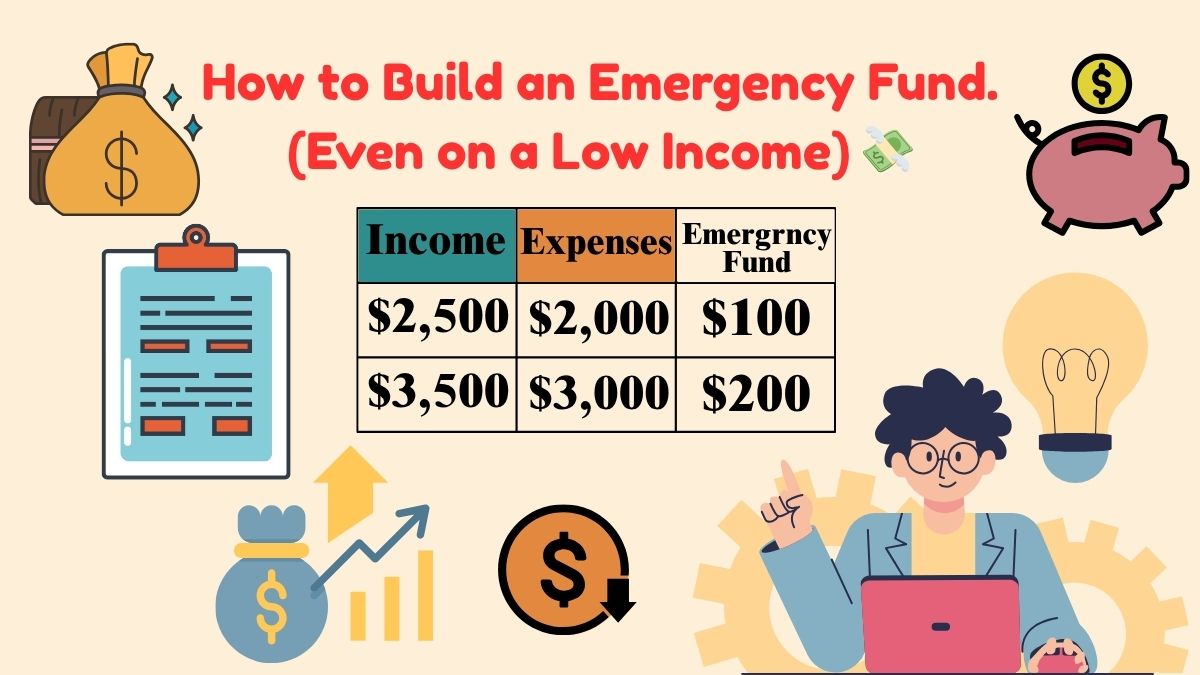

If you’re living on a tight budget, How to Build a $1000 Emergency Fund (Even on a Low Income) can feel impossible. But here’s the good news: building a $1000 emergency fund is doable even if cash is tight. In this guide, we’ll break down how to save $1000 emergency fund quickly, where to keep it, and how to make it stick—without feeling like you’ve sworn off coffee forever.

Table of Contents

What Is an Emergency Fund vs. Savings?

Your emergency fund is a financial safety net for life’s “oh no” moments—flat tires, urgent vet bills, surprise copays. Savings can be for planned stuff—travel, holidays, tech upgrades. Think of it like this: emergency fund = need money; savings = want money.

- Why Only $1000 Emergency Fund to Start?

A starter $1000 emergency fund gets you out of the danger zone fast. It covers most 1k emergency personal expense hits: car repair, urgent dental visit, or a last‑minute flight home. It’s not your final goal—just Level 1 so you stop relying on high‑interest credit cards.

- Is a $1000 Emergency Fund Enough?

Short‑term? Often yes. Long‑term? Usually no. A $1000 emergency fund buys you time and reduces stress. Once you hit $1K, the next target is 3–6 months of expenses. But start simple: $1K first, then scale.

🔗 Related:

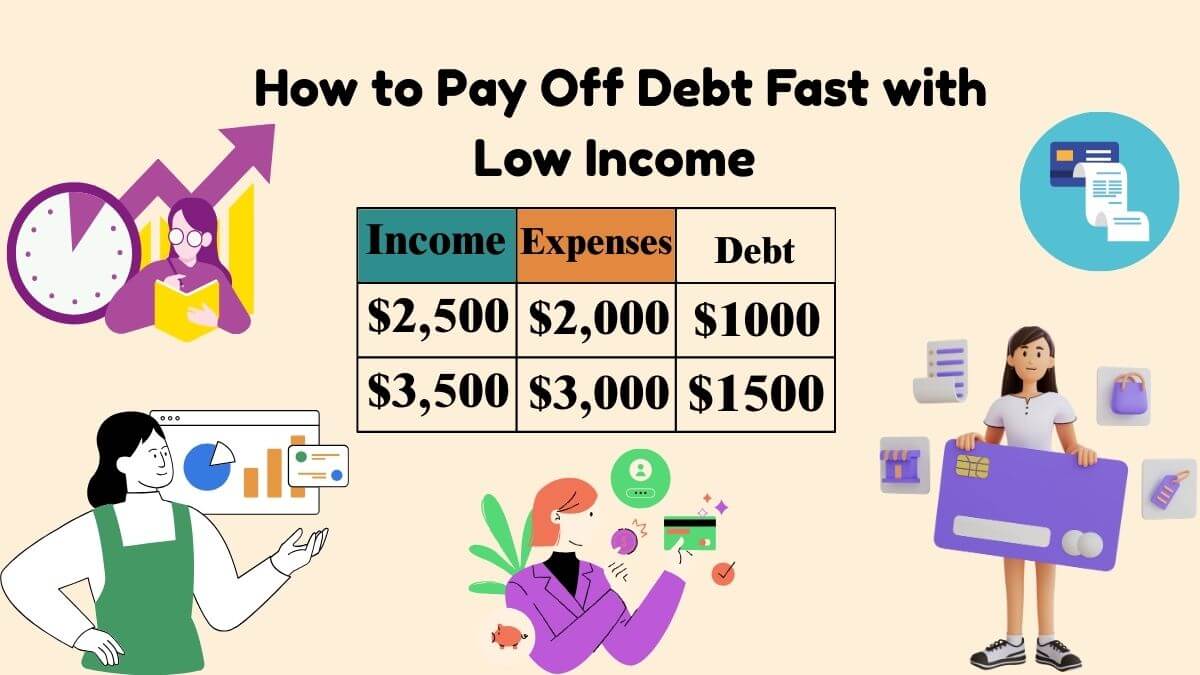

- 👉 How to Pay Off Debt Fast with Low Income

- 👉 Sample Budget for $2,500 a Month

- 👉 How to Pay Off Debt Fast with Low Income

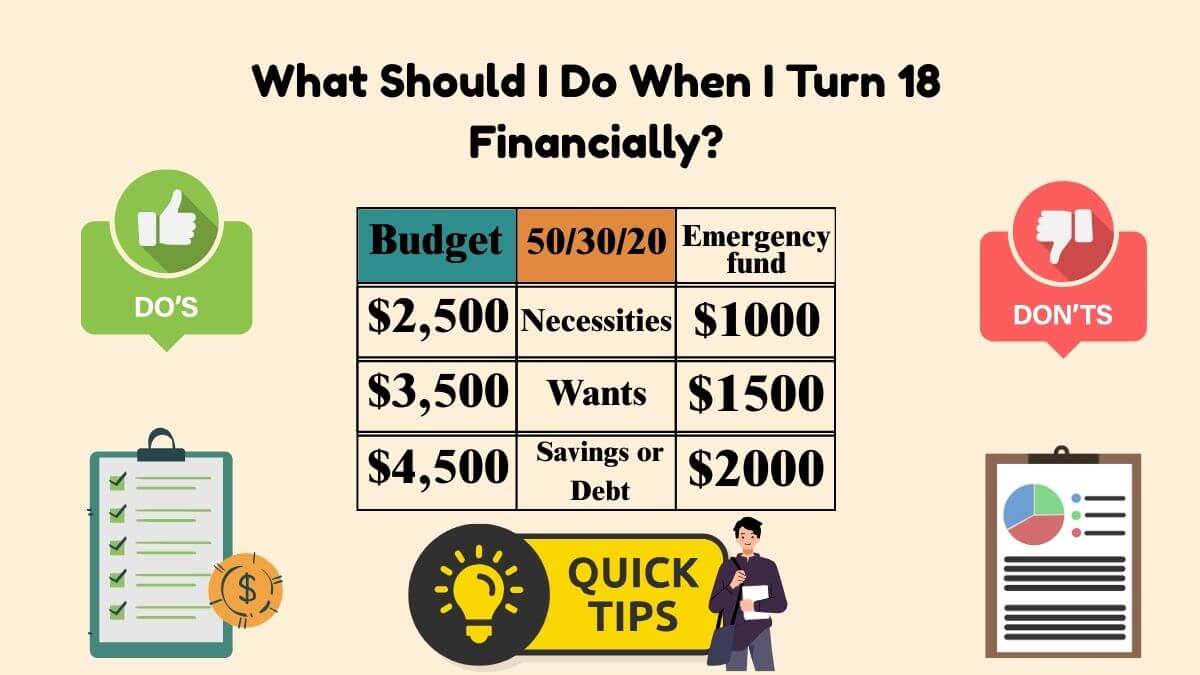

- 👉 What Should I Do When I Turn 18 Financially?

- 👉 How to Build an Emergency Fund (Even on a Low Income)

- 👉 What Should I Do When I Turn 18 Financially?

How Big Should an Emergency Fund Be?

Most money pros suggest three to six months of essential expenses. If your job is unstable or you’re self‑employed, aim toward the high end.

How Much Is 6 Months’ Emergency Fund?

Add up rent, groceries, utilities, transportation, insurance, and minimum debt payments—skip nice‑to‑haves. Multiply by 6. If essentials are $1,800/month, 6 months = $10,800.

At Your Age, a Fully Funded Emergency Fund Should Be…

- Students/early 20s: $1K starter, then 1–3 months.

- Mid‑20s to 30s: 3–6 months, especially if renting or changing jobs.

- With kids/mortgage/freelance: 6–12 months for extra stability.

How to Save a $1000 Emergency Fund—Fast

Here’s the zero‑fluff plan to how to build 1000 dollar emergency fund on a low income.

The 30‑Day “$1K Emergency Personal Expense” Sprint

- Freeze wants for 30 days (streaming, takeout, Uber).

- Sell 5 things you don’t use (old phone, console, furniture).

- Shift big bills: ask for promo rates on internet/phone, or lower insurance.

- Bank extra hours/side hustle: Instacart weekends, pet‑sitting, freelancing.

- Automate $10/day → $300 in a month without thinking.

Micro‑Saving Playbook for Low Income

- Round‑ups: Every purchase rounds up to savings.

- Cash envelope for “fun”: when the envelope’s empty, you’re done.

- No‑spend weekdays: choose Mon–Thu as spend‑free.

- Refund rule: tax refunds, rebates, cash‑back → straight to the fund.

💡 Pro Tip:

Automate a transfer on payday. You’ll never “forget” to save because the money moves before you can spend it.

The $1000 Emergency Fund Challenge (Gamified)

Turn saving into a game. Pick your 1000 dollar emergency fund challenge path:

Pick Your Path: 20×$50, 40×$25, or Mix & Match

- 20 deposits × $50 = $1,000 in under 3 months.

- 40 deposits × $25 = $1,000 in about 4–5 months.

- Hybrid ladder ($20/$25/$50/$75/$100) keeps motivation high.

Printable/Trackable 1000 Emergency Fund Chart

Use the chart below. Each box = one deposit. Color it in or mark “done”.

| Box # | Amount | Done (Y/N) | Date |

|---|---|---|---|

| 1 | 25 | ||

| 2 | 25 | ||

| 3 | 50 | ||

| 4 | 20 | ||

| 5 | 75 | ||

| … | … | … | … |

| Total | $1,000 |

Download the full tracker in the template below—it includes a complete 1000 emergency fund chart and a ready‑to‑use checklist.

Where to Keep Your Emergency Fund

High‑Yield Savings Account (HYSA) wins for most people:

- Pros: safe, liquid, earns interest, FDIC/NCUA coverage.

- Avoid locking funds in CDs or investments—emergencies need quick access.

This is the smart call in the emergency fund vs. savings debate: keep the emergency stash separate from your “vacation/goal” savings.

12‑Month Emergency Fund Plan (Stretch Goal)

Once you hit $1K, scale up with this 12 month emergency fund plan:

| Month | Target Add | Cumulative Goal |

|---|---|---|

| 1 | $100 | $1,100 |

| 2 | $100 | $1,200 |

| 3 | $150 | $1,350 |

| 4 | $150 | $1,500 |

| 5 | $200 | $1,700 |

| 6 | $200 | $1,900 |

| 7 | $250 | $2,150 |

| 8 | $250 | $2,400 |

| 9 | $300 | $2,700 |

| 10 | $300 | $3,000 |

| 11 | $350 | $3,350 |

| 12 | $350 | $3,700 |

How Much Money Do You Need to Survive Monthly?

List only essentials (rent, food, utilities, transport, insurance, minimum debt). That’s your survival number. Multiply by 3–6 for your fully funded emergency target.

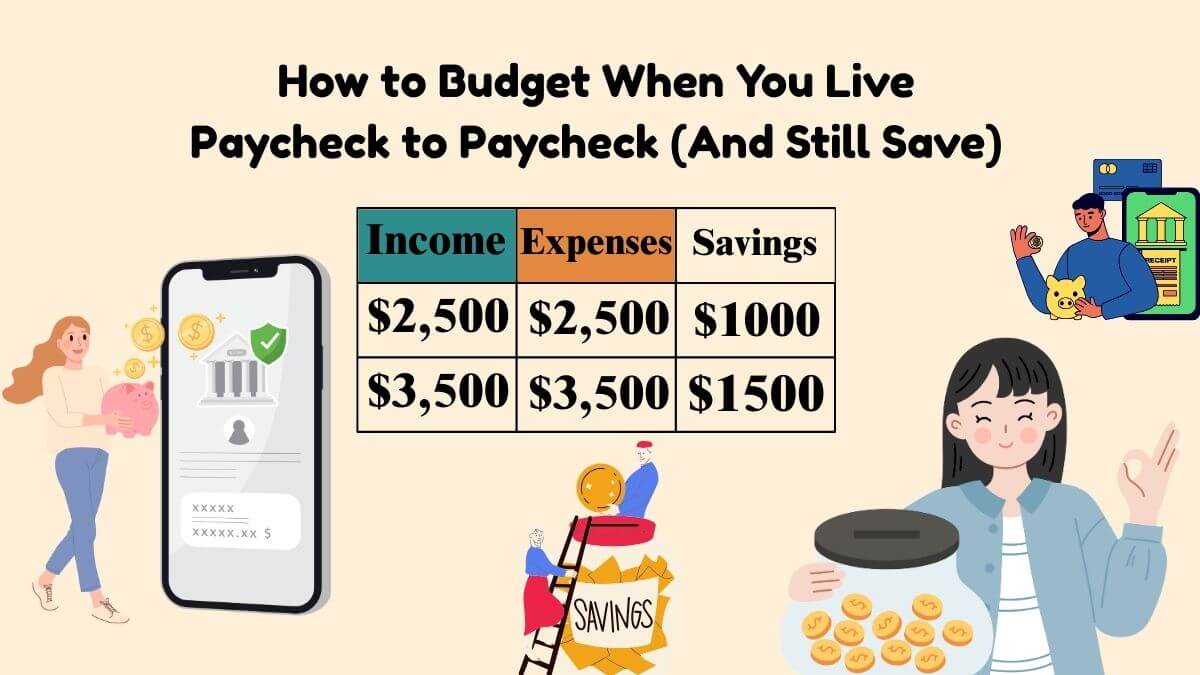

Sample Budget That Builds a $1K Fund on Low Income

$2,500 Monthly Budget With Built‑In Savings

Here’s a realistic sample that prioritizes How to Build a $1000 Emergency Fund (Even on a Low Income) while you’re also paying bills:

| Category | Amount ($) |

|---|---|

| Income | 2,500 |

| Rent/Room | 1,000 |

| Utilities + Internet | 125 |

| Groceries | 250 |

| Transportation | 150 |

| Insurance/Health | 125 |

| Debt Payments | 150 |

| Subscriptions | 50 |

| Discretionary/Fun | 100 |

| Emergency Fund (Pay Yourself First) | 300 |

| Other Savings/Goals | 100 |

| Total Expenses | 2,450 |

| Leftover (buffer) | 50 |

Automation & Rules That Keep You on Track

- Rule #1: Savings moves on payday.

- Rule #2: Any bonus/overtime → 50% to emergency fund.

- Rule #3: Refunds, cash‑back, gifts → 100% to emergency fund until you hit $1K.

💡 Pro Tip:

If rent is high, cut “wants” for 60–90 days and consider a roommate. It’s the fastest way to unlock cash flow.

Progress Dashboard & Downloads (2025 Templates)

2025 Excel & Google Sheets Budget + $1K Tracker

Download now:

Grab your professional budget template with:

- Monthly Budget 2025 sheet (auto totals & net).

- Download the 2025 Emergency Fund & Budget Template

- Emergency Fund Tracker (goal, % to goal, months to goal).

- 1K Challenge (pre‑filled boxes that sum to $1,000).

Reality Check: How Many Americans Have $1,000 in Savings?

Search interest in how many Americans have $1000 in savings and what percentage of Americans have $1000 in savings spikes every year because the number moves. Surveys from major banks and news outlets often show a large share of U.S. adults would struggle to cover a $1,000 emergency in cash. The exact percentage changes year by year, so check the latest 2025 survey from a reputable source. Either way, your goal stays the same: build your $1K cushion now and keep going.

Pro Tips: How to Build a $1000 Emergency Fund

- Automate success: Set a recurring transfer the moment your paycheck lands.

- Name your account: “Emergency Only”—it helps you respect the boundary.

- Windfall rule: 50–100% of irregular money (tax refund, side gig, gifts) → the fund.

- Keep it boring: If the money is hard to grab, it’s hard to spend—use a separate bank.

Conclusion

Starting small is not “thinking small.” Building How to Build a $1000 Emergency Fund (Even on a Low Income) is the first real step from financial anxiety to financial control. Use the $1000 emergency fund challenge, follow the 1000 emergency fund chart, and track everything in the 2025 Excel & Google Sheets template. Once you hit $1K, keep going—3–6 months of expenses will make you future‑proof.

FAQs

1) What’s the best place to keep my $1000 emergency fund?

A high‑yield savings account—it’s safe, liquid, and earns interest, making “emergency fund vs. savings” an easy call.

2) How fast can I build a $1000 emergency fund on low income?

Many people hit it in 30–90 days using a mix of spending freezes, side gigs, and small daily transfers.

3) Should I invest my emergency fund?

No. Emergency money must be risk‑free and accessible. Invest only after your starter fund is set.

4) Is a $1000 emergency fund enough for families?

As a starter, yes. Then work toward 3–6 months of essential expenses, or even 12 months for extra security if you’re self‑employed.

5) Can I use the $1000 for car repairs or medical copays?

Yes—that’s exactly what it’s for. Use it, then rebuild it immediately.