To Build an emergency fund is one of the most important financial steps you can take to protect yourself and your family from unexpected expenses. Whether you’re dealing with a low income or simply looking for ways to prioritize your finances, having an emergency fund will provide a much-needed safety net.

In this guide, we’ll walk you through how to build an emergency fund—even if you’re living paycheck to paycheck. We’ll also explain the difference between an emergency fund vs savings, how much you should have in your emergency fund, and why it should be a top priority for your financial security.

Table of Contents

Why Should an Emergency Fund Be a Top Priority?

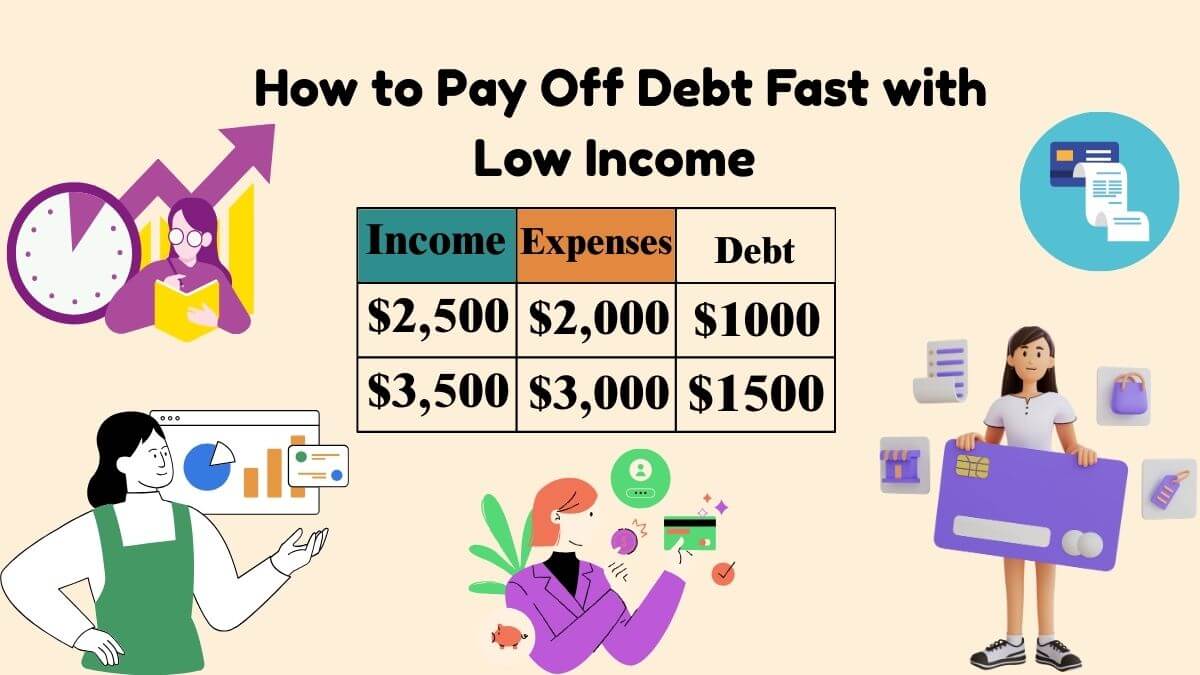

An emergency fund is essential because it helps you avoid going into debt when unexpected costs arise. Whether it’s a medical emergency, car repair, or sudden job loss, an emergency fund is your financial safety net, allowing you to handle emergencies without relying on credit cards or loans.

- Reduces financial stress: Knowing you have funds available can give you peace of mind in times of crisis.

- Protects against debt: Instead of turning to high-interest debt, your emergency fund covers the cost of unexpected expenses.

- Prepares you for the future: Building an emergency fund now prepares you for the inevitable challenges life throws at you.

💡 Pro Tip: According to Reddit, many millennials struggle to save enough for an emergency fund. It’s vital to prioritize it, no matter how small your income is. Here’s a thread from Reddit on how to calculate your emergency fund.

🔗 Related:

- 👉 How to Build a $1,000 Emergency Fund (Even on a Low Income)

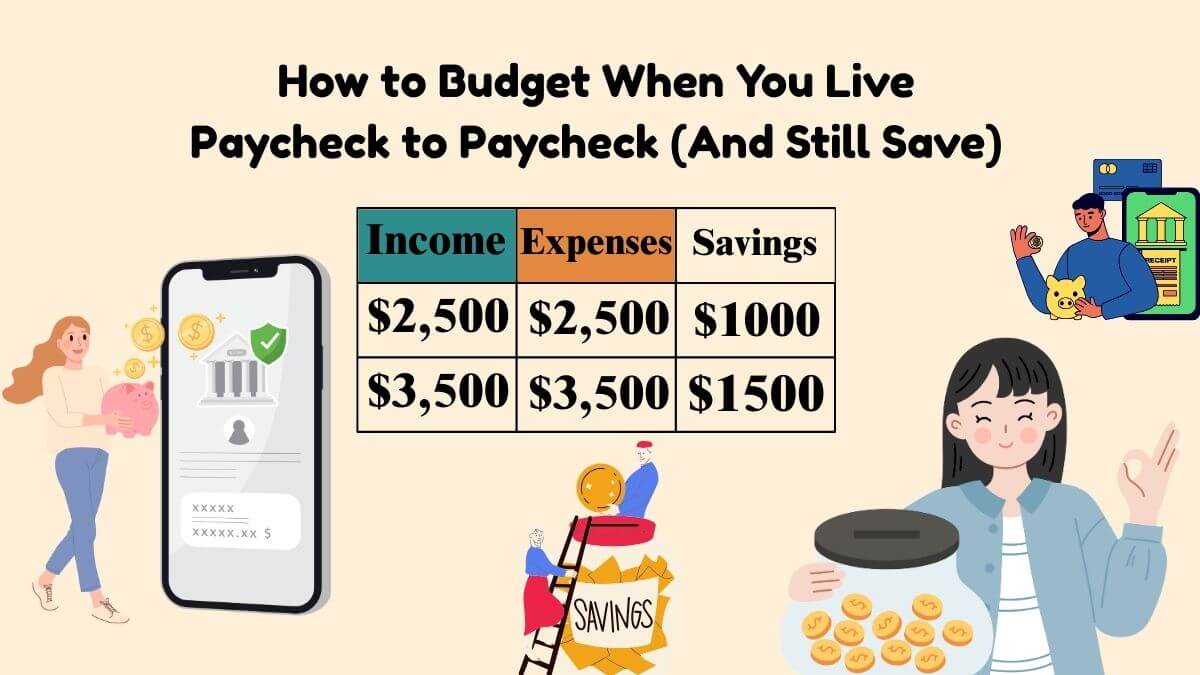

- 👉 How to Budget When You Live Paycheck to Paycheck (And Still Save)

Emergency Fund vs. Savings: What’s the Difference?

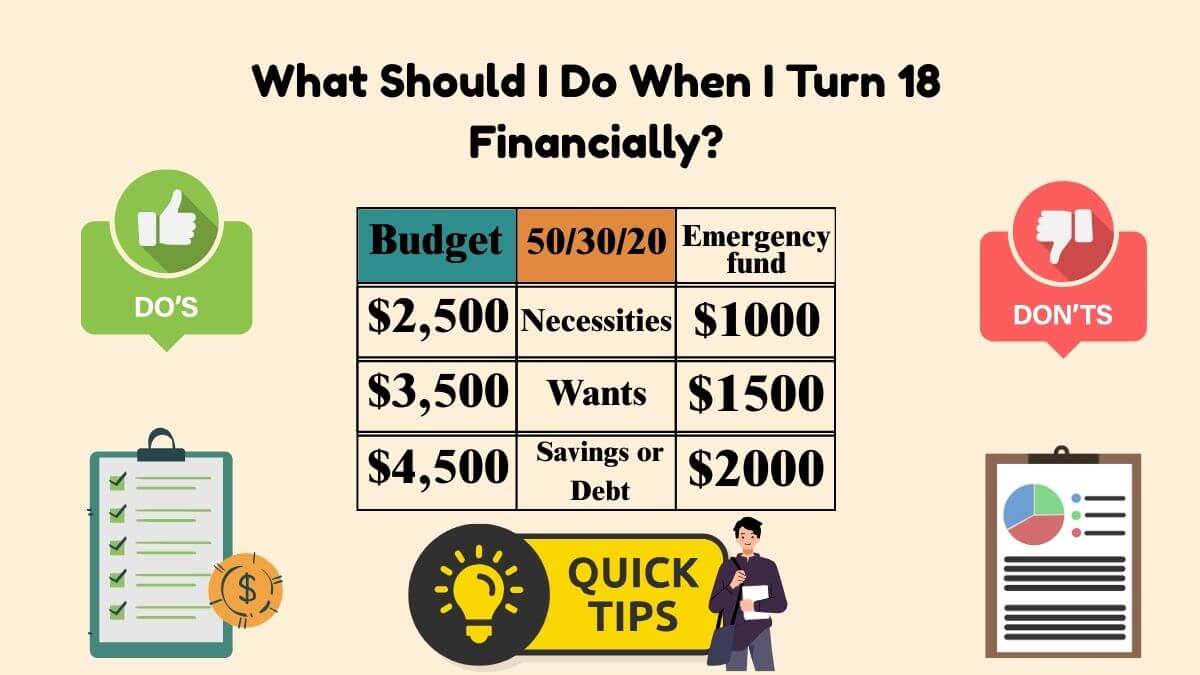

It’s important to understand the difference between an emergency fund and savings. While both are essential for your financial health, they serve different purposes:

- Emergency Fund: Money set aside to cover unexpected emergencies, such as medical bills, car repairs, or job loss.

- Savings: Money set aside for future goals like vacations, a new home, or retirement.

💡 Pro Tip: Your emergency fund should be separate from your savings so you’re not tempted to dip into it for non-emergencies.

How Much Should Be in Your Emergency Fund?

The general rule of thumb is to have 3–6 months’ worth of expenses in your emergency fund. This allows you to cover basic costs if you lose your job or face other unexpected expenses. But how much is that exactly?

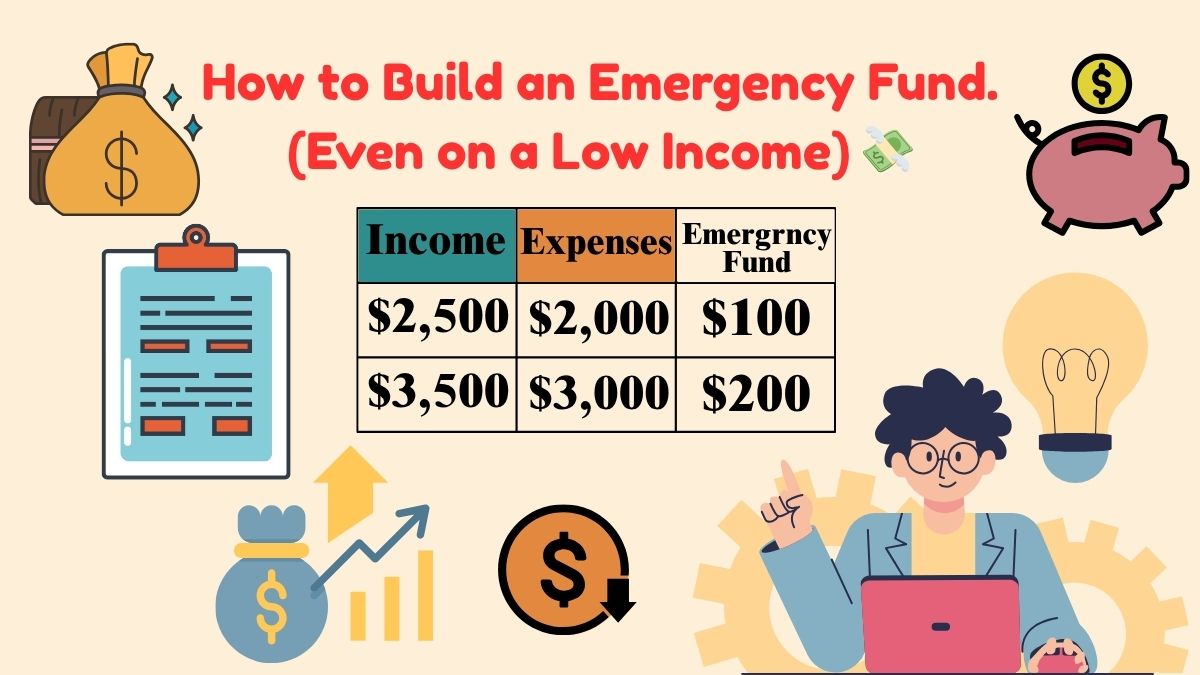

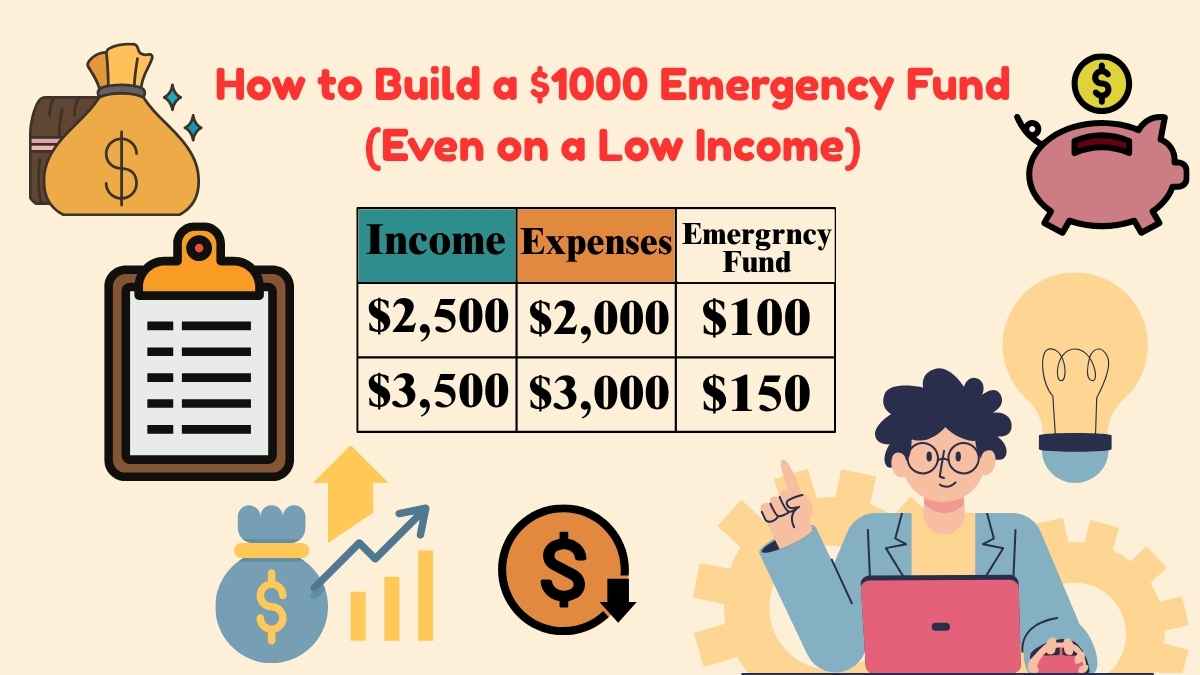

Let’s break it down:

- Monthly expenses: Calculate your monthly expenses, including rent, utilities, groceries, and transportation.

- 3-6 months of expenses: Multiply your total monthly expenses by 3 or 6 months.

💡 Pro Tip: If you’re working with a low income, start small. Even setting aside $50–$100 a month will eventually add up. Read more on how much should be in your emergency fund on Reddit.

Build an Emergency Fund on a Low Income

Even on a low income, you can start building your emergency fund. Here are some steps to get you started:

1. Start Small and Be Consistent

- Start by setting aside a small amount—even $25–$50 per month. The key is to make consistent contributions.

- Automate savings: Set up an automatic transfer to your emergency fund each payday to make sure you save consistently.

2. Cut Back on Unnecessary Spending

- Track your expenses and look for non-essential items to cut back on.

- Consider meal prepping to save money on food, or limit dining out to reduce costs.

3. Use Windfalls and Bonuses

- If you receive a bonus, tax refund, or any other unexpected windfall, consider putting 50% or more of it toward your emergency fund.

4. Avoid Using Your Emergency Fund for Non-Emergencies

- It can be tempting to dip into your emergency fund for big-ticket items or planned purchases, but this defeats the purpose of having it.

💡 Pro Tip: Building an emergency fund might take time, but don’t give up. Small, steady contributions will add up over time.

How to Calculate Your Emergency Fund

When deciding how much to save, it’s helpful to use this simple formula:

- Track your monthly expenses: Add up your essential monthly costs, including rent, utilities, food, transportation, and insurance.

- Multiply by 3 to 6 months: This gives you your emergency fund goal. For example, if your monthly expenses total $1,500, your emergency fund goal should be between $4,500 and $9,000.

💡 Pro Tip: Use a budgeting app like Mint to easily track your monthly expenses and monitor your progress toward your emergency fund goal.

Build an Emergency Fund While Buying a House

If you’re also saving for a house, it can be tempting to focus solely on a down payment. But it’s important to build your emergency fund while saving for a home. Here’s how:

- Prioritize Your Emergency Fund: Ensure that you have a minimum of 3 months’ worth of expenses in your emergency fund before focusing on buying a house.

- Set Separate Savings Goals: Have one account for your emergency fund and another for your home down payment.

- Adjust Your Timeline: If necessary, extend your timeline for buying a house so you can comfortably build both your emergency fund and down payment.

How Much in Emergency Fund Should You Have? Reddit Insights

According to Reddit discussions on personal finance, many recommend having 3–6 months’ worth of expenses in your emergency fund. However, it’s okay to start with a smaller amount and gradually increase your savings as you earn more or reduce expenses. Reddit Thread on How Much Should Be in Your Emergency Fund.

Ready to Make It Work?

Want to create a customized budget for your income and build your emergency fund faster? Fill out this form and get a free monthly budget template to help you manage your finances effectively!

Build an emergency fund : Conclusion

Building an emergency fund is one of the smartest financial decisions you can make. Even if you’re on a low income, taking small steps toward saving each month can help you build financial security. Prioritize your emergency fund, avoid dipping into it for non-emergencies, and keep building steadily over time.

FAQs:

Q: How much should I have in my emergency fund?

A: It’s recommended to have 3–6 months of expenses saved up. For a low income, start with a smaller amount and build it up gradually.

Q: What is the difference between an emergency fund and savings?

A: An emergency fund is for unexpected expenses like medical bills or job loss, while savings are for future goals like a vacation or buying a house.

Q: Can I still build an emergency fund on a low income?

A: Yes! Start small with $25–$50 per month. Consistency is key to building your emergency fund over time.