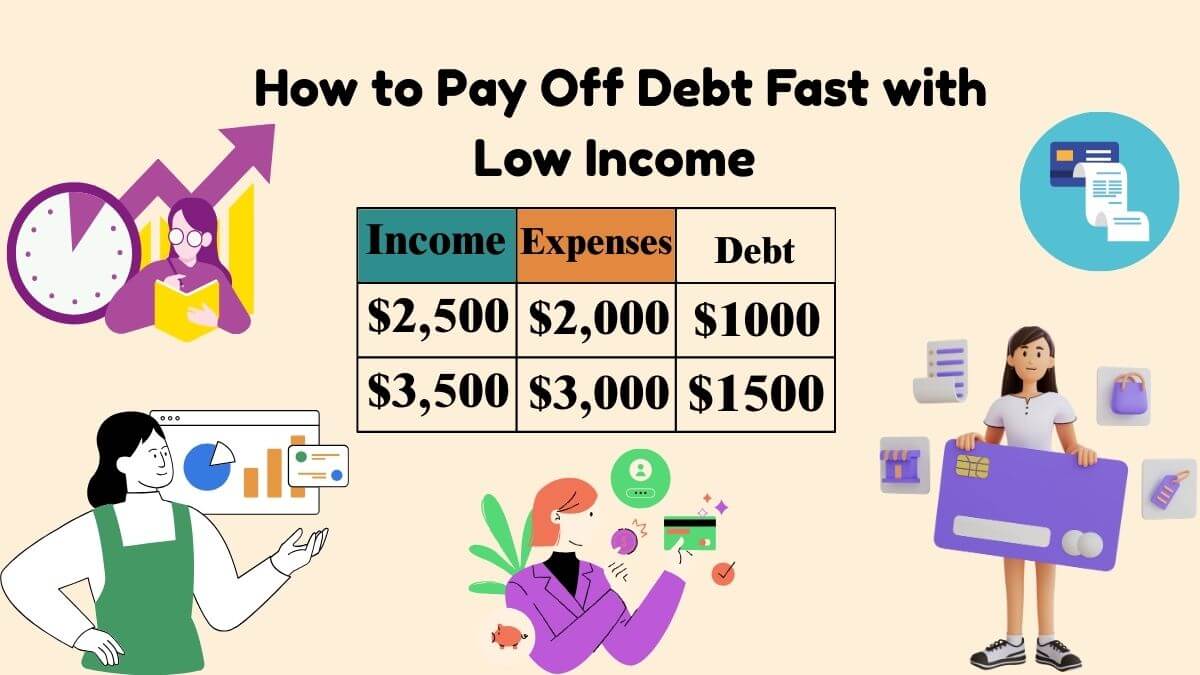

Debt can feel overwhelming, especially when you’re living on a low income. How to pay off debt fast with low income is a common question that many people ask as they face financial difficulties. Despite the challenges, paying off debt is possible even on a limited budget. The key is creating a structured plan, focusing on high-interest debts first, and being consistent with your repayment strategy.

In this post, we’ll break down actionable steps, from budgeting effectively to using debt payoff strategies like the Debt Snowball and Debt Avalanche. By the end of this guide, you’ll know exactly how to tackle debt with minimal income and see measurable progress in your financial journey.

Table of Contents

What Does It Mean to Pay Off Debt Fast on a Low Income?

Paying off debt quickly while on a low income means being intentional about your finances and making every dollar count. For many, it might seem impossible to pay off debt quickly with a small paycheck, but it’s all about prioritizing your financial obligations.

A low income does not mean you cannot be debt-free; rather, it means you need to be more strategic with your resources. This could involve cutting unnecessary expenses, setting a strict budget, and making small adjustments that can free up extra funds to pay towards your debt.

🔗 Related:

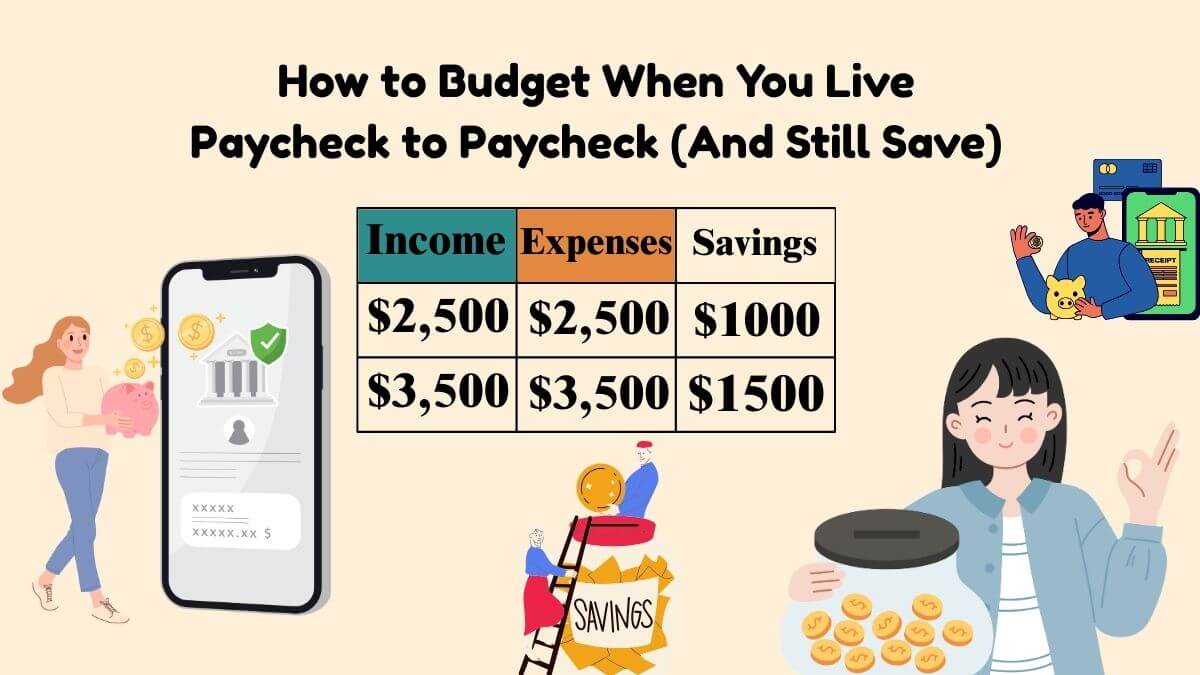

- 👉 How to Budget When You Live Paycheck to Paycheck (And Still Save)

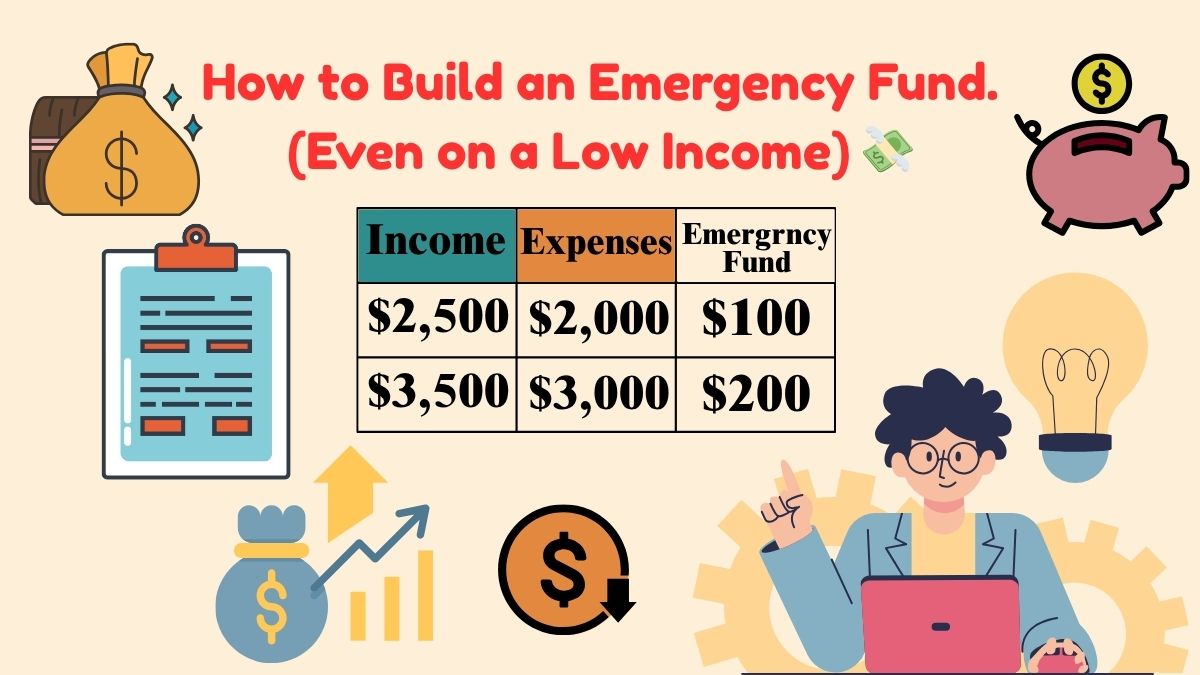

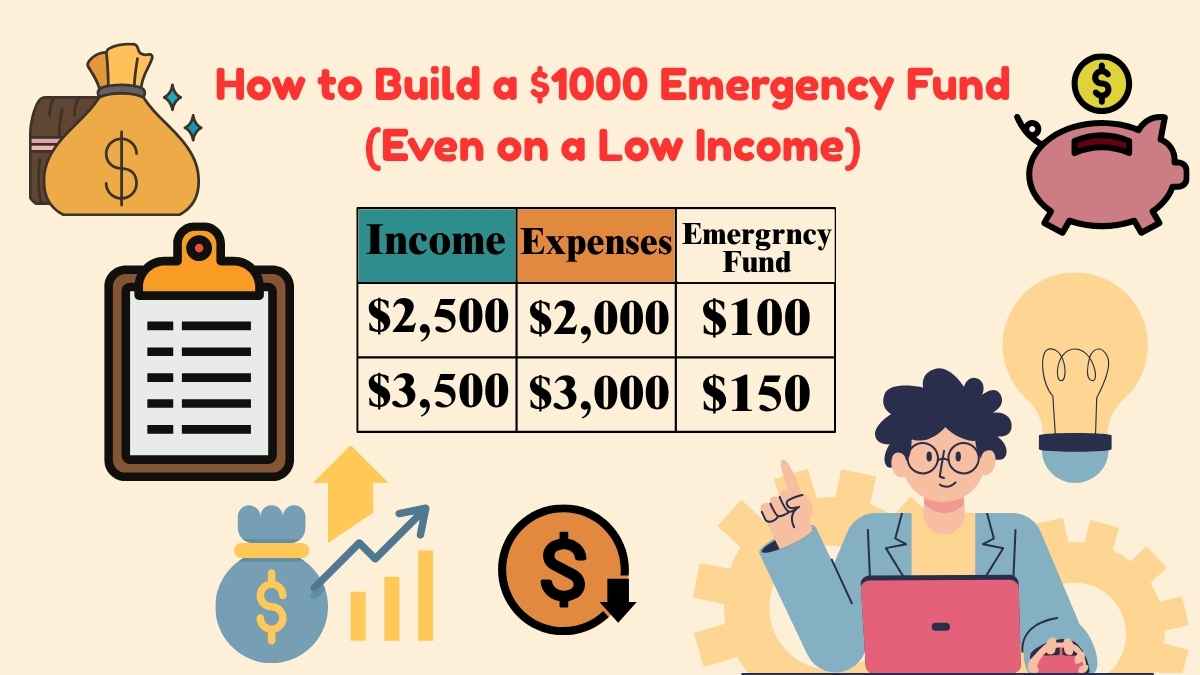

- 👉 How to Build a $1000 Emergency Fund (Even on a Low Income)

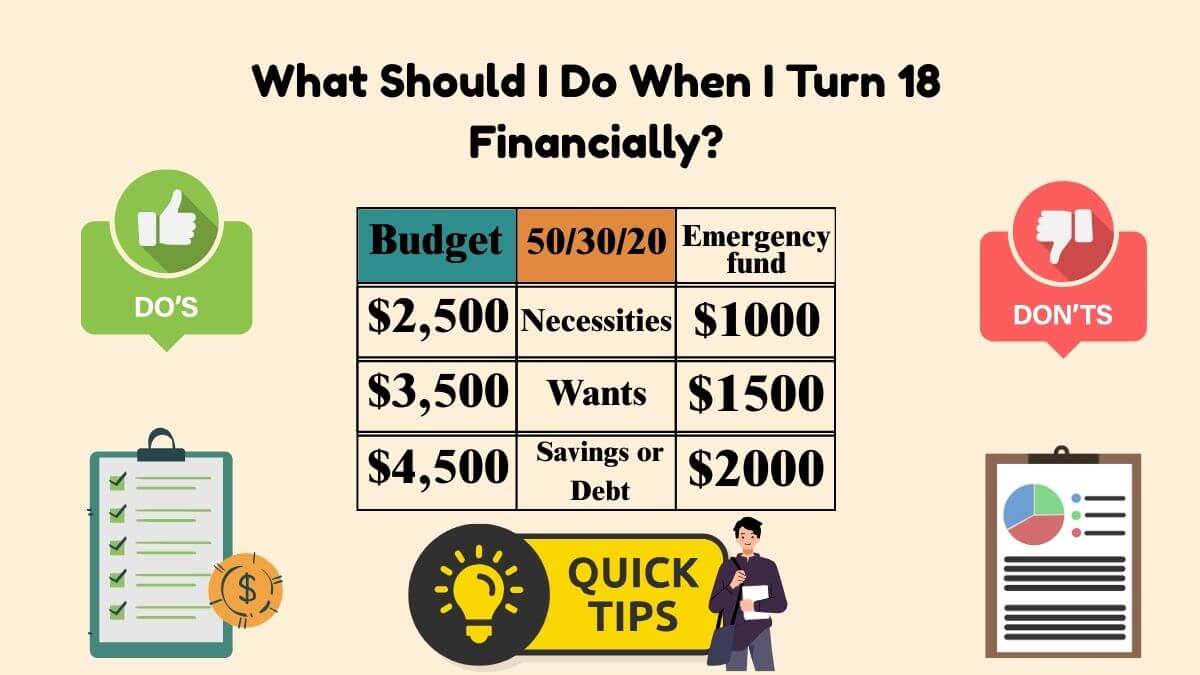

- 👉 What Should I Do When I Turn 18 Financially?

- 👉 How to Pay Off Debt Fast with Low Income

- 👉 Sample Budget for $2500 a Month: A Realistic Guide for Young Adults

How to Pay Off $25000 in Debt Fast

Paying off a substantial debt, like $25,000, may seem impossible with a low income. However, with determination and the right strategy, it’s achievable. Here are some steps to Pay Off $25000 in Debt Fast:

- Set a timeline: Break down the $25,000 into smaller monthly goals. A timeline will help you stay focused.

- Use the Debt Snowball or Debt Avalanche method: Focus on either the smallest debt first or the highest interest debt.

- Increase income: Look for ways to boost your income, such as side gigs or freelance work, to speed up your debt repayment.

💡 Pro Tip:

Use the Debt Payoff Calculator to track your progress and adjust as needed.

How to Pay Off Credit Card Debt Faster

Credit card debt can be particularly damaging to your financial health due to its high-interest rates. The faster you pay it off, the less interest you will pay over time. Here’s how to pay off credit card debt quickly:

- Pay more than the minimum: Always pay more than the minimum payment to reduce the balance faster.

- Transfer to a lower-interest card: If you have access to a card with a lower interest rate, consider transferring your balance.

- Focus on high-interest cards first: Use the Debt Avalanche method to pay off the highest-interest debt first.

The Best Way to Pay Off Debt Fast: Create a Debt Snowball or Debt Avalanche Plan

When it comes to paying off debt fast, the Debt Snowball and Debt Avalanche methods are two of the most effective Way to Pay Off Debt Fast.

- Debt Snowball: This method involves paying off your smallest debt first and then working your way up to larger debts. This method is more psychological, as it gives you quick wins and motivates you to keep going.

- Debt Avalanche: In this method, you focus on paying off the debt with the highest interest rate first. This strategy saves you the most money in the long run but may take longer to give you a sense of progress.

How Do I Pay Off Credit Card Debt Fast?

To pay off credit card debt fast, you need to create a repayment strategy that works for your budget. Start by prioritizing the debt with the highest interest rate, then:

- Track your expenses: Keep a detailed budget so you can allocate more funds towards your credit card debt.

- Cut back on discretionary spending: Reduce spending on non-essential items to free up more cash for debt repayment.

- Use the snowball method for motivation: If you need encouragement, paying off smaller debts first can give you the momentum to tackle larger ones.

How Fast Do Ivy League Students Pay Off Debt?

Students from Ivy League universities often graduate with significant debt, but they also tend to earn high salaries after graduation. Many Ivy League students pay off their student loans faster due to higher income potential, but the time it takes can still vary. Typically, students with advanced degrees or those entering high-paying fields may pay off their debt in 5-10 years.

How Fast Do Medical Students Pay Off Their Debt?

Medical students often graduate with substantial debt, sometimes exceeding $200,000. The time it takes to pay off this debt can vary based on salary and living expenses. On average, medical professionals can pay off their loans within 10-20 years, depending on their income and repayment strategy.

How to Pay Off Debt Fast with Low Income on Reddit

Reddit is filled with real-life stories of individuals paying off debt with low income. Many users suggest:

- Cutting unnecessary subscriptions

- Selling unused items for extra cash

- Picking up side gigs to increase income

- Prioritizing high-interest debts

The Reddit Debt-Free Community offers tons of advice, from budgeting tips to motivational stories.

Using Debt Payoff Calculators for Fast Repayment

There are various online calculators that can help you create a plan for paying off debt fast. These tools help you set a timeline for repayment and see how much interest you will pay. Use a Debt Payoff Calculator to figure out how much you need to pay each month and how long it will take.

How Fast Does Credit Go Up After Paying Off Debt?

Once you start paying off debt, especially credit card debt, your credit score can increase over time. The exact rate depends on several factors, including how much of your available credit you’re using and your payment history. Typically, you will see a noticeable improvement within 1-3 months after paying off your debt.

Proven Strategies to Tackle Student Debt Fast

Paying off student loans quickly is possible, even on a low income. Here are a few strategies:

- Use an income-driven repayment plan: This lowers your monthly payment based on income.

- Pay off private loans first: These usually have higher interest rates than federal loans.

- Consider refinancing: If your credit is good, you might qualify for a lower interest rate.

How to Pay Off Debt with Low Income: Tips and Best Practices

Some best practices for paying off debt with a low income:

- Track every dollar you spend

- Prioritize high-interest debts

- Look for side income opportunities

- Use budgeting apps to stay on track

Want a FREE 2025 Budget Template & Customized Budget Plan?

Let me help you build your plan — for free.

Fill out this form to get a personalized monthly budget based on:

- Your income

- Your real expenses

- Your goals (debt-free, travel, fund, etc.)

👉 Tap here to request your custom plan

Why start from scratch? I’ve created a free Excel & Google Sheets budget template tailored for a $2500 monthly income.

📌 Download Your Free Budget Template Here

Conclusion

Paying off debt fast, even on a low income, is possible if you have the right strategies. Whether you use the Debt Snowball or Debt Avalanche, or even combine both, the key is staying consistent and adjusting as needed. By focusing on high-interest debts first, increasing your income, and tracking your progress, you’ll see results in no time.

FAQs : Way to Pay off Debt With Low Income

1. What is the fastest way to pay off debt with low income?

A. The fastest way is to focus on high-interest debts first while reducing discretionary spending.

2. How do I manage debt on a low income?

A. Creating a strict budget, cutting unnecessary expenses, and focusing on high-interest debts are key.

3. How much should I have in an emergency fund before paying off debt?

A. Aim for at least $500 to $1000 in your emergency fund before aggressively tackling debt.

4. How long does it take to pay off credit card debt?

A. Depending on the balance and monthly payments, it can take anywhere from a few months to several years.

5. Should I focus on credit card debt or student loans first?

A. If your credit card debt has a higher interest rate, it should be paid off first. If your student loan has a lower rate, focus on the credit cards.