If you’re earning $2,500 a month and wondering, “Where does it all go?” — you’re not alone. Whether you’re a fresh grad renting your first apartment, a millennial balancing student loans, or a Gen Z professional craving travel freedom, budgeting is the key to keeping your money in check.

In this post, we’ll break down a realistic sample budget for $2500 a month, share pro tips, answer popular budgeting FAQs, and even give you a free downloadable budget template so you can start right away.

Table of Contents

Understanding the Basics of Budgeting

Before we dive into numbers, you need to understand why budgeting works. It’s not about restricting your lifestyle — it’s about directing your money towards your goals.

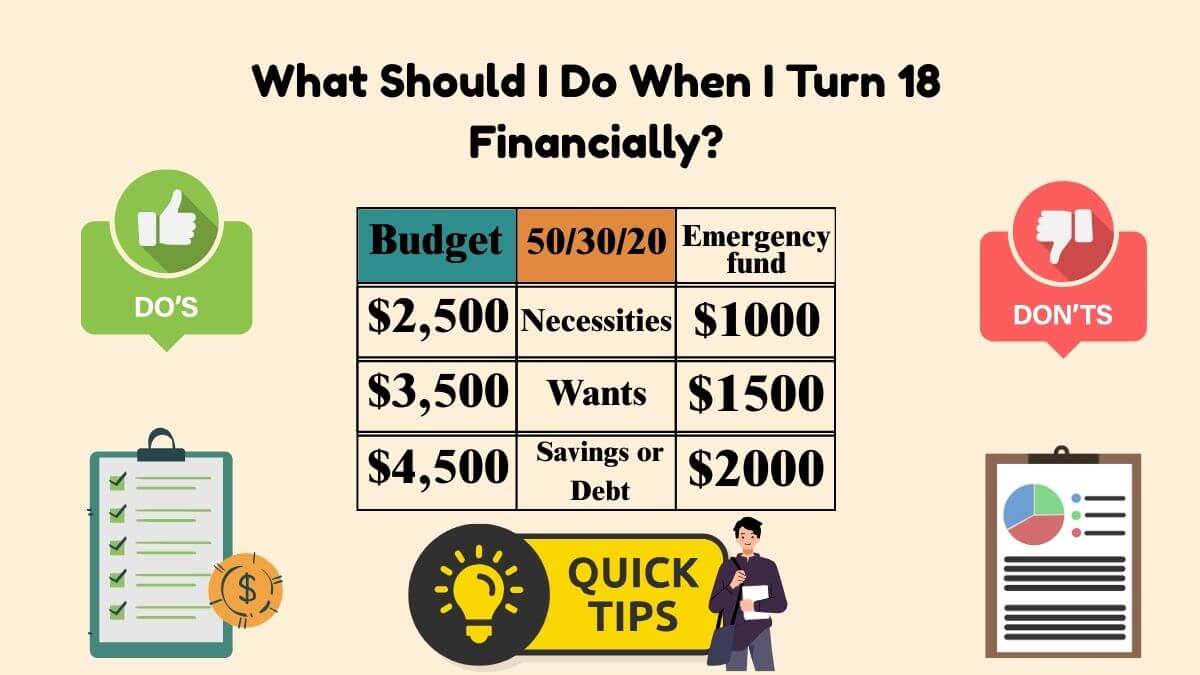

The 50/30/20 Rule is a great starting point:

- 50% Needs → Rent, utilities, groceries, insurance

- 30% Wants → Dining out, Netflix, travel, hobbies

- 20% Savings/Debt → Emergency fund, investments, student loans

Pro Tip 💡:

If your rent eats more than 35% of your income, try cutting down on “wants” for a few months or finding a roommate to balance your budget.

🔗 Related:

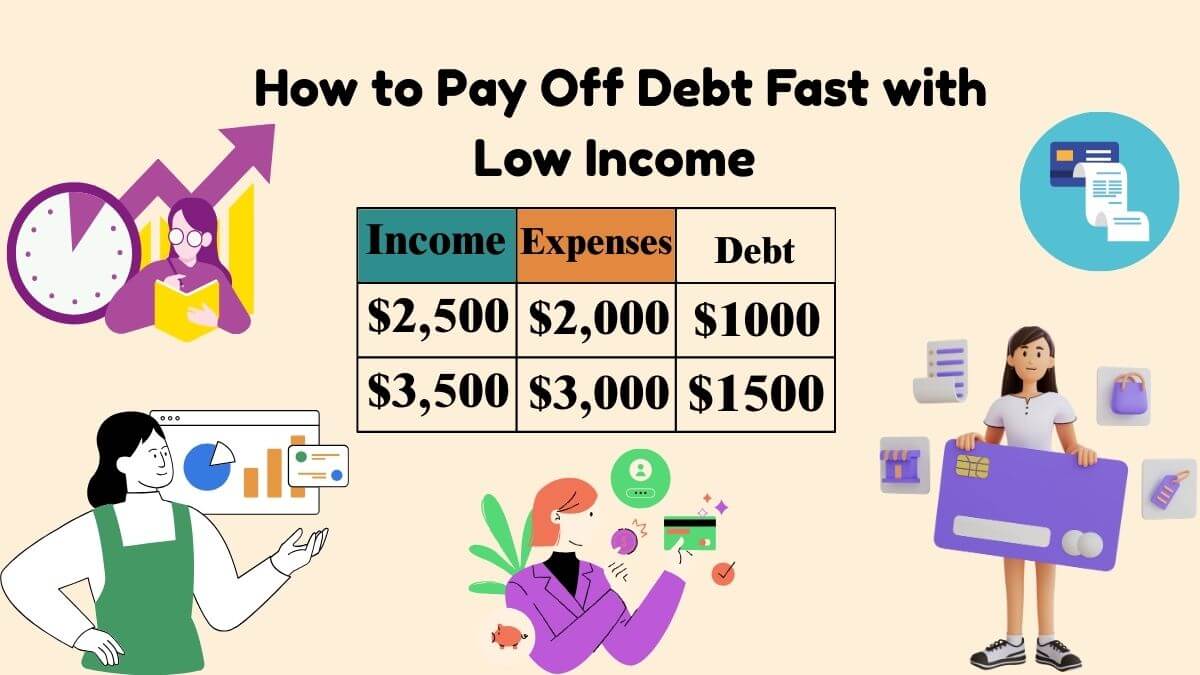

- 👉 How to Pay Off Debt Fast with Low Income

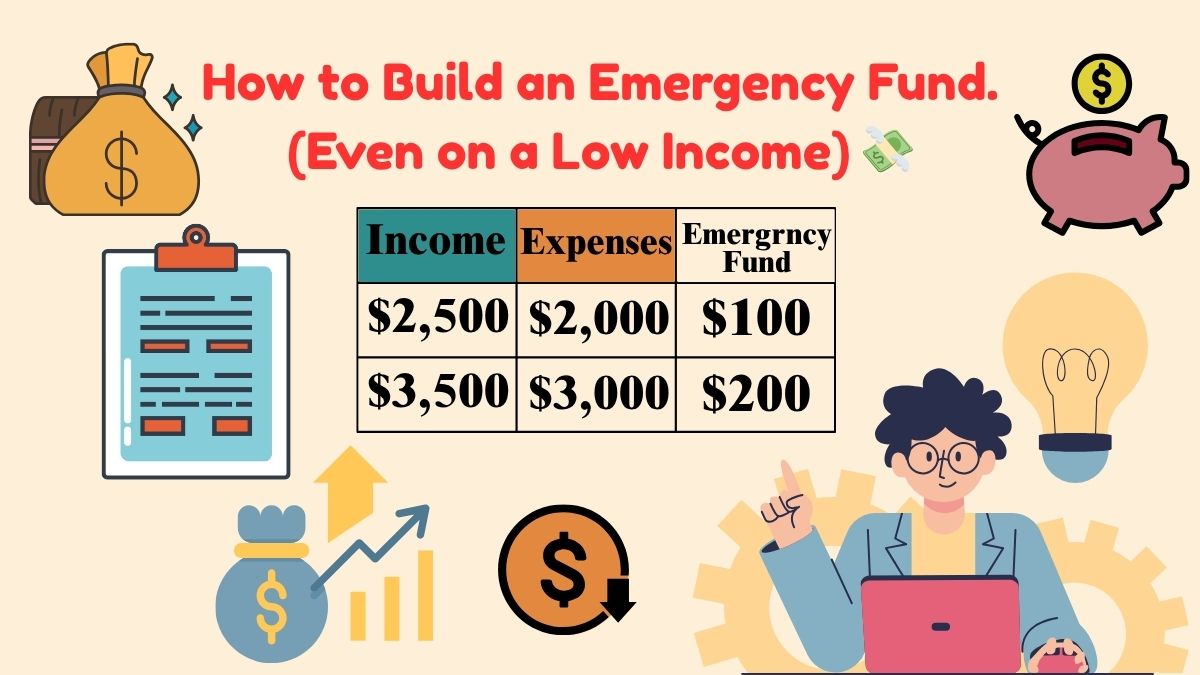

- 👉 How to Build an Emergency Fund (Even on a Low Income)

- 👉 What Should I Do When I Turn 18 Financially?

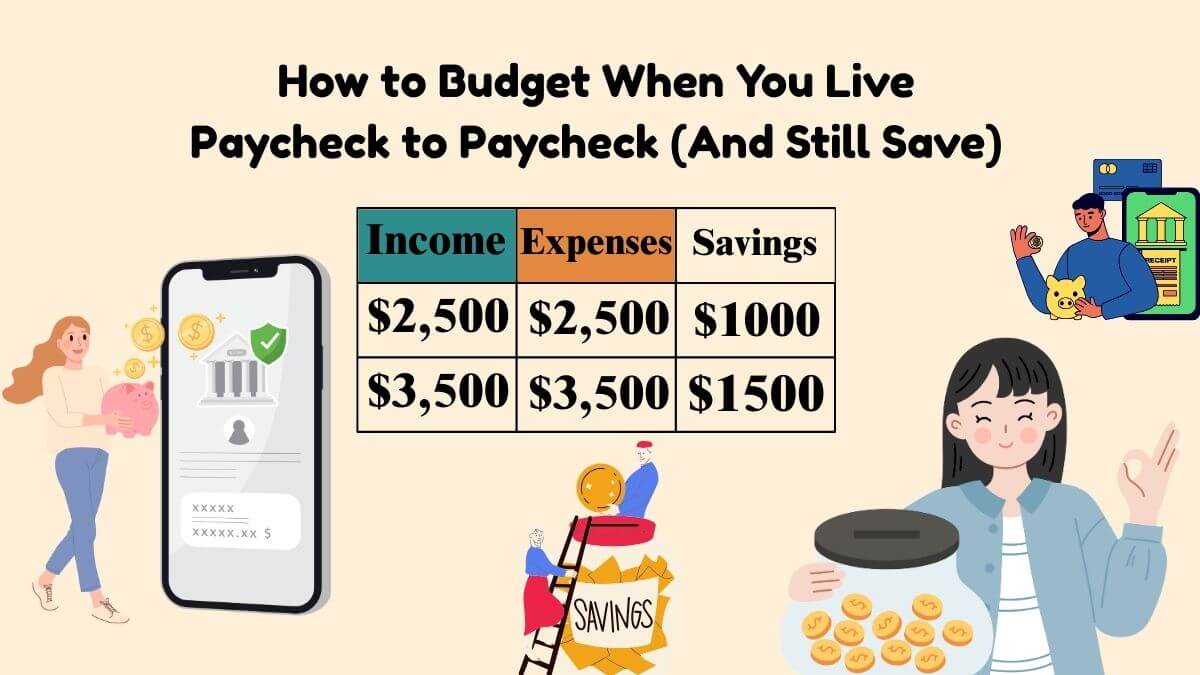

- 👉 How to Budget When You Live Paycheck to Paycheck (And Still Save)

Sample Budget for $2500 a Month (50/30/20 Rule)

Here’s how your money could be divided:

| Category | % of Income | Amount ($) |

|---|---|---|

| Needs | 50% | $1,250 |

| Wants | 30% | $750 |

| Savings/Debt | 20% | $500 |

Breakdown for Budget for $2500 a Month

Needs ($1,250)

- Rent & Utilities: $900

- Groceries: $250

- Insurance: $100

Wants ($750)

- Eating Out & Coffee Runs: $200

- Streaming Services & Subscriptions: $50

- Travel Fund: $300

- Entertainment: $200

Savings/Debt ($500)

- Emergency Fund: $200

- Investments (Index Funds, ETFs): $200

- Student Loan Payment: $100

Pro Tip 💡:

Automate your savings on payday. You’ll never “forget” to save because the money moves before you can spend it.

Adjusting Your Budget for Real Life

Life isn’t static — your budget shouldn’t be either.

- Got a side hustle? → Allocate extra income to savings or paying off debt faster.

- Unexpected bills? → Pull from “wants” before dipping into savings.

- Moving to a new city? → Reassess housing costs immediately.

Pro Tip 💡:

Review your budget every 90 days. Your priorities will shift as you grow, and so should your spending plan.

How to Stick to Your $2500 Budget Without Feeling Broke

- Use Cash for Discretionary Spending: Withdraw your “fun money” in cash so you can see it disappearing.

- Meal Prep Like a Pro: Cut grocery bills by cooking in batches.

- Unsubscribe Audit: Cancel unused subscriptions — you’d be shocked how much you waste.

- Reward Yourself: Set small milestones (e.g., “If I save $500 this month, I’ll buy that thing I’ve been eyeing.”)

Pro Tip 💡:

Download budgeting apps like YNAB, Mint, or PocketGuard — they sync with your bank and track your spending automatically.

Free Downloadable 2025 Budget Template

Why start from scratch? I’ve created a free Excel & Google Sheets budget template tailored for a $2500 monthly income.

📌 Download Your Free Budget Template Here

Pro Tip 💡:

Save a copy to your Google Drive so you can update it from your phone on the go.

📌 Want a FREE Customized Budget Plan?

Let me help you build your plan — for free.

Fill out this form to get a personalized monthly budget based on:

- Your income

- Your real expenses

- Your goals (debt-free, travel, fund, etc.)

👉 Tap here to request your custom plan

Final Thoughts 💬

A sample budget for $2500 a month isn’t just about numbers — it’s about creating financial breathing room so you can live life and plan for the future. Start small, review often, and remember: you’re in control of your money, not the other way around.

FAQs About a Sample Budget for $2500 a Month

Q1. What if my rent is more than $900?

Ans: Cut down on wants temporarily or consider relocating/downsizing.

Q2. How much rent can I afford on $2500 income?

Ans: Ideally no more than $1000 (40% of income).

Q3. What percentage should I save on $2500 income?

Ans: Aim for 4–6%, even if it’s small.

Q4. Is $2500 enough for a family of two?

Ans: Possible in affordable areas with careful planning.

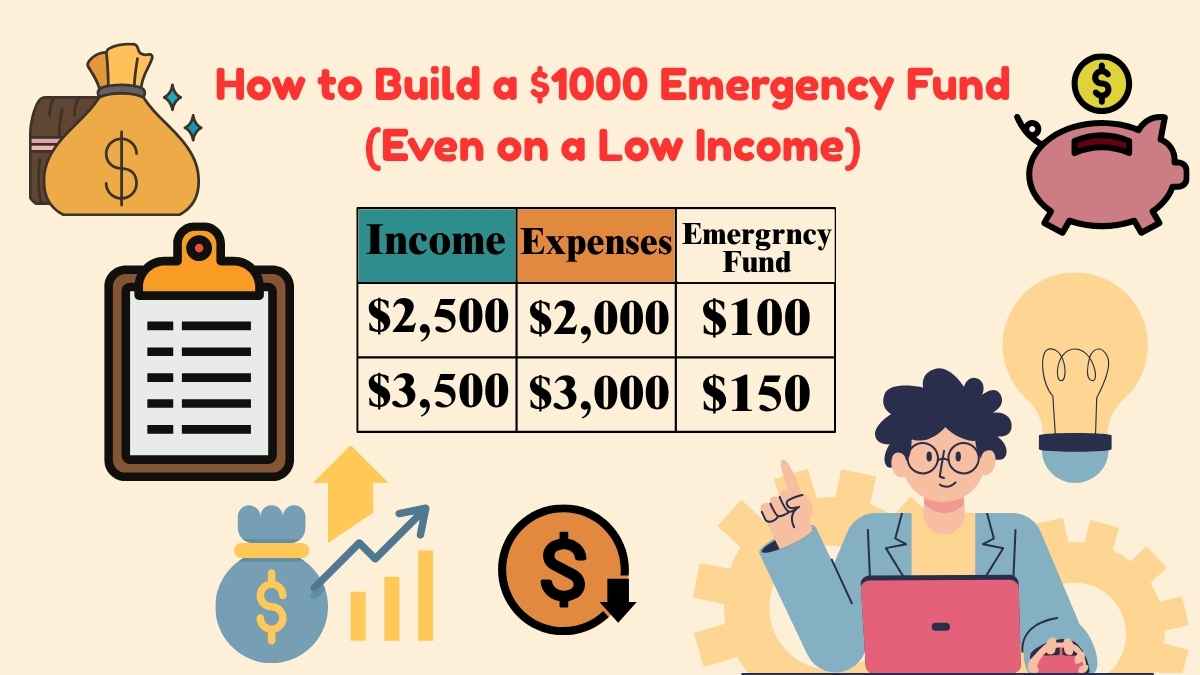

Q5. How do I budget for emergencies on $2500?

Ans: Allocate a small monthly savings amount and keep it in a separate account.

Q6. Can I still travel if I make $2500/month?

Ans: Yes! Allocate part of your “wants” to a travel fund and consider budget-friendly destinations.

Q7. How much should I keep in my emergency fund?

Ans: Aim for 3–6 months of expenses. Start small — even $50/month helps.

Q8. Should I invest if I still have debt?

Ans: Yes, but prioritize high-interest debt first. Split contributions between debt repayment and low-risk investments.